Virtua Partners

Virtua Advantage

Core Values

Capability

About

Leadership

Virtua Footprint

Partners

Contact

Virtua Partners Header

Strategic Innovation

Strategic Innovation:

The Virtua Advantage

We seek out competitive advantages. We strive to turn challenges into opportunities to deliver the right solution, for the right time, and the right place.

Here’s how:

Proven Team

Internationally recognized brands trust our expertise and rely on our capabilities. We are deeply engrained in our subjects of expertise, each team led by authorities with lifelong careers in their chosen disciplines. Driven and collaborative, we are experienced in both growth and down markets, focused on the goal of delivering value in any cycle.

Life Cycle Management

Our funding, development, and management process is fully integrated in-house with frontline specialists to provide thoughtful and thorough solutions. We direct each stage of the investment life cycle to target risk mitigation, cost controls, and return optimization.

Cycle Resistant

We endeavor to build deals that thrive in both long and short market cycles. Our proven team, tax-advantaged focus, market diversity, and conservative debt structure work together, striving to deliver risk-adjusted returns.

Good Neighbor Benefit

We build strong community relationships to assist in synergizing opportunities and securing tax advantages for long-term project viability, while creating jobs and housing where we work. Being a good neighbor is good business.

Virtua Partners Core Values

Core Values

Principles drive every decision, every day.

These are a few of our core drivers:

Investor-Centric

ApproachWe want our investors to achieve financial freedom and long-term financial stability; their needs and risk profile are always at the forefront of any decision making.

Absolute

TransparencyWe strive for complete transparency to investors as we guide them through the investment strategy, capital deployment, and asset disposition.

Sophisticated

AdaptabilityOur experience through the market cycle gives us the unique ability to adapt to market trends, providing value-add strategies when markets turn adverse.

Comprehensive

ExperienceOur expertise across a range of verticals, along with our family of companies, allows us to successfully execute on investment opportunities.

Capabilities

Private Equity

Development

Delaware Statutory Trust

Private Equity

Capital formation, fund structuring, fund administration, issuer sales, investor relations, and compliance for commercial real estate investments

Development

Deal acquisition, due diligence, deal structuring, entitlements, engineering, governmental relations, and dispositions for commercial real estate across North America

1031 Exchanges, Delaware Statutory Trust

1031 Exchange and Delaware Statutory Trust administration, and management for commercial real estate investments

Virtua Partners Headline

Virtua Partners Headline

Virtua Partners Grid

Virtua Partners Headline

Virtua Partners Grid

Virtua Partners Headline

Virtua Partners Grid

Leadership Team

Our team has deep experience managing commercial real estate investments through multiple market cycles. We are problem solvers who see opportunity in challenging markets and difficult projects. Our distinct advantage is our adaptability to complex market conditions and our expertise across multiple disciplines.

Quinn Palomino

Co-Founder & Principal

Bret A. Maidman

Executive Vice President, General Counsel

Nick Montague

Senior Vice President, Finance

Sunny Huang

Vice President, Research, Analysis & Underwriting

Quinn Palomino

Co-Founder & Principal

Entrepreneur, $2B in Workouts

Quinn is Principal and Co-Founder of Virtua Partners and its integrated real estate companies, which support the firm’s expertise in capital management, development, and asset management. Quinn has grown the company to managing over 2.7 Million square feet of commercial real estate nationwide. Prior to her current role, Quinn was the Director of Business Development for a commercial real estate workout firm in San Diego, CA where she participated in more than $2 Billion of TIC investments. She also accredits much of her valuable experience to her role as Partner at a San Diego-based construction and development firm, where she worked on projects with California state and city governments. Quinn was recently appointed to the board of the Arizona Commerce Authority.

Bret A. Maidman

Executive Vice President, General Counsel

30+ Years Experience

Bret is Executive Vice President and General Counsel for the Virtua group of companies. He also sits on Virtua Credit’s investment committee. Bret has over 30 years of legal experience in both business transactions and commercial, bankruptcy, and appellate litigation. He has acted as lead counsel on matters ranging from complex real estate and finance transactions to restructuring operating companies to litigating Chapter 11 plans through confirmation. Bret has been active in local, state, and national bar associations, written articles and spoken at numerous legal programs, represented pro bono clients in trial and appellate court proceedings, and served as a Pro Tem Judge for the Arizona Court of Appeals and President of the Arizona chapter of the Turnaround Management Association. For the first 19 years of his practice, Bret was an associate and partner at one of the leading law firms in the Southwest. He also practiced with a smaller firm and as a solo practitioner. Bret attended Brown University, where he graduated magna cum laude with majors in history and psychology, and Northwestern University School of Law, where he was Articles Editor for the Northwestern University Law Review.

Nick Montague

Senior Vice President, Finance

$4B in CRE Loan Analysis

Nick is Senior Vice President of Finance at Virtua Partners. He oversees finance, underwriting, deal acquisition, due diligence, deal structuring, and dispositions. With over 15 years of real estate experience, Nick has analyzed over $4 Billion of commercial real estate loans and investment opportunities. Nick has also managed a portfolio of development deals in excess of $250 Million.

Prior to heading up finance at Virtua, he worked with a commercial real estate workout and restructuring advisory company. Nick has experience encompassing a wide variety of commercial real estate property types across the country with specific focus on, finance, underwriting, proformas, valuations, complex joint ventures, capital structures, repositions, workouts and development. He received a BS from California State University, Long Beach with a double major in finance and international business.

Sunny Huang

Vice President, Research, Analysis & Underwriting

Sunny provides leadership at our Hong Kong Office, overseeing research and marketing in Asia, and supports Virtua in M&A, underwriting, and marketing globally. Her team builds financial models for potential investments and workout opportunities, with deep, localized research for commercial real estate, with market assessments, financials, and economic analysis.

Sunny has comprehensive research and acquisition experience in private equity with leading Chinese firms. She received an MSc in Investment Management from the Hong Kong University of Science and Technology, and a B.S. in Finance from Zhejiang University.

Virtua Stats

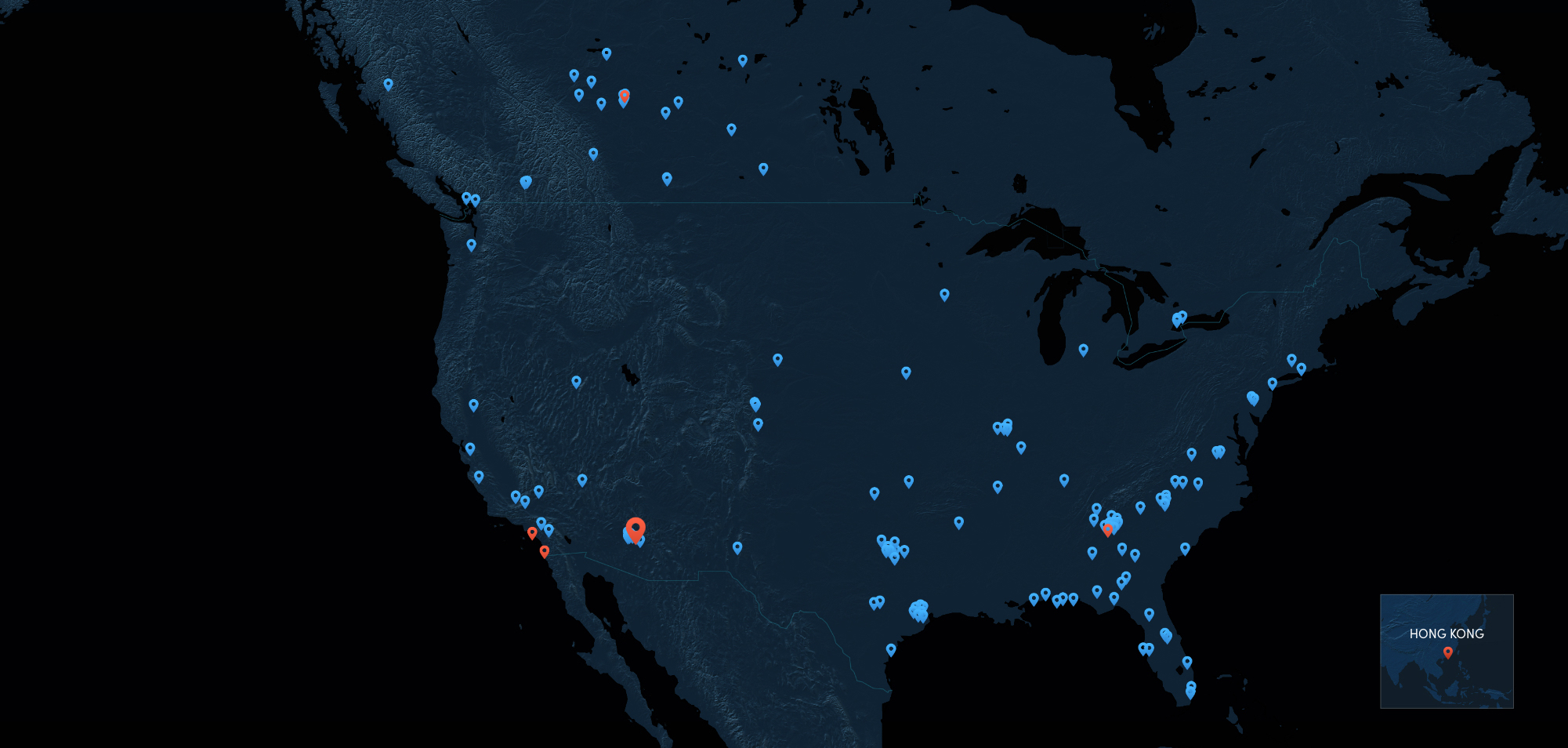

Virtua Footprint

$1.2B

Restructurings

& Transactions20

Active High

Growth & Fixed

Income Funds10+

States

50+

Assets Sponsored

$220M+

Capital Raised

Our Offices

Scottsdale

San Diego

Virtua Portfolio Companies

Virtua About Us Review

Contact Us

Whether you’re a prospective investor, advisor, hotel owner, or partner we have the expert to talk with you.

Contact Us